Using this Resource Center

Resource Center:

Understanding and Engaging Tech Buyers

Marketing Insights to Engage Decision Makers

Welcome to the ultimate Resource Center for Understanding and Engaging Tech Buyers, your strategic destination for understanding the needs and preferences of today’s technology buyers. This center contains a collection of insights and tools to help you craft messaging, build campaigns, and align content with what matters most to your audience.

How to Use this Resource Center

The Resource Center is organized by buyer stage: Awareness, Consideration, and Decision. Each section is grounded in findings from the 2025 Tech Buyer Preferences Survey and is designed to help you reach your buyers with the right message at the right time.

As you navigate the Resource Center, explore the interactive charts to dive deeper into buyer behavior by industry, company size, and role. Use these visuals to spot trends, uncover opportunities, and support your marketing decisions with real data.

Throughout this content, watch for highlighted buyer persona callouts. These short insights reflect the priorities of key decision makers, giving you a quick way to tailor your marketing based on role-specific needs.

You will find a variety of interactive and downloadable resources, including guides, blog posts, and infographics. These materials are ready to support your strategy, whether you are building a new campaign or fine-tuning your content plan. Each resource is designed to be practical, actionable, and easy to integrate into your workflow.

This Resource Center is designed to help you move from insight to execution with clarity and confidence. Whether you’re developing content or refining your approach, the findings from the 2025 Tech Buyer Preferences Survey provide actionable guidance to help you connect more effectively with today’s tech buyers.

Executive Summary

Understanding how decision makers identify, evaluate, and invest in technology is crucial for effective marketing. This analysis delivers key insights into the behaviors and preferences of IT and finance leaders, including:

- How tech buyers discover and assess new solutions

- The core motivators behind technology purchasing decisions

- The influence of marketing on vendor selection

- The most effective marketing strategies for engaging decision makers

- Content formats and messaging approaches that resonate with buyers

By leveraging these insights, B2B marketers can fine-tune their strategies, deliver compelling value propositions, and build trust throughout the buying journey.

About the Tech Buyer Study

About the 2025 Tech Buyer Preferences Survey

BlueWhale Research’s SURVEY program was used to gather research insights from senior technology decision-makers at B2B companies within the software, business services, and finance industries. A total of 359 respondents from 343 unique companies within the United States and Canada participated in the survey conducted in early 2025.

Respondents were senior decision-makers (Directors and above) responsible for overseeing technology investments, making them highly influential in the vendor selection process. The survey respondents represented companies with annual revenues exceeding $10 million, ensuring a focus on organizations with the resources to make strategic decisions. The program relied solely on closed-ended questions, focusing on specific, limited responses to gather data on their priorities and preferences.

These survey results provide actionable insights into how North American businesses evaluate new technology solutions and engage with marketing content throughout the buying journey.

Awareness Stage

Buyer Stage: Awareness

The Awareness stage is the beginning of the tech buyer’s journey. It often starts with a realization that something needs to change. A process feels inefficient, a system no longer meets the needs of the team, or a competitor gains an edge. With that spark, the search for answers begins.

At this stage, buyers are not yet focused on specific vendors. Instead, they are exploring the landscape, trying to understand what solutions exist and which ones might help solve their emerging challenges. This early phase is shaped by trust and curiosity. Buyers turn to peer reviews, industry events, and expert content to guide their exploration. These trusted sources help them make sense of complex options and highlight which technologies are worth a closer look.

For marketers, this is a crucial moment. It is a chance to be discovered through credible voices and third-party validation, building early trust before a buyer ever visits a website or talks to a sales rep.

Identifying Solutions

How Tech Buyers Identify Leading Solutions

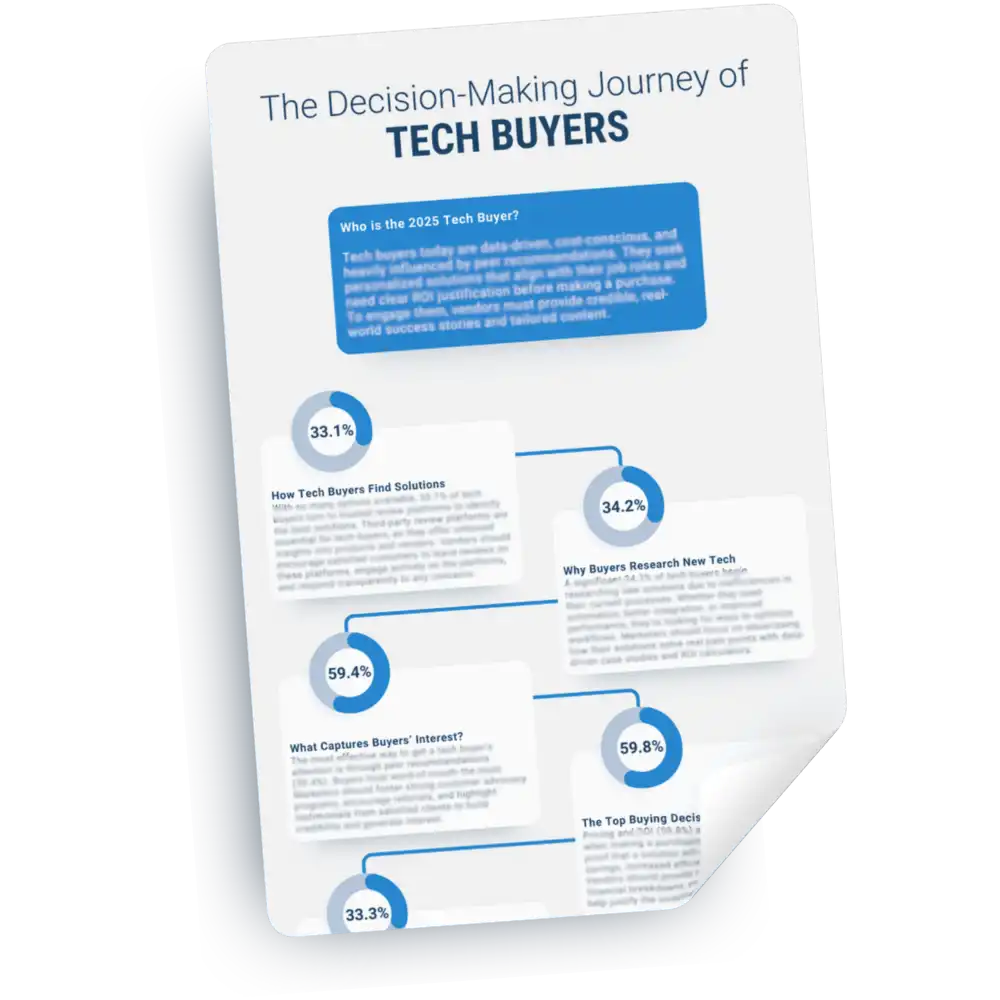

One of the most critical aspects of the technology buying process is identifying leading solutions at the earliest stage of evaluation. Tech buyers primarily rely on trusted review platforms and industry conferences to discover new technologies. Over half (56.5%) of respondents cited peer-driven sources as their primary method for identifying potential solutions, demonstrating the high level of trust placed in external validation.

Review platforms are even more important for larger enterprises. Nearly half of companies with annual revenues exceeding $1 billion or 5,000 or more employees consider reviews on trusted platforms to be their primary source of information. These organizations are more likely to turn to peer-driven insights, so it is important for marketers to incorporate peer testimonials and success stories across their messaging.

In the finance and software industries, expert opinions also hold significant weight. Decision makers in these fields frequently rely on industry articles and video content created by thought leaders, suggesting that trust extends beyond peer networks to recognized experts .

These findings underscore the necessity for marketers to prioritize third-party validation in their strategies. Ensuring that a product or service is well-represented on reputable review platforms and leveraging industry events for exposure can significantly improve visibility among target buyers. With 43.5% of buyers turning to vendor produced content first, marketers can further leverage peer success stories and industry expert endorsements within that content to increase engagement and credibility.

Research Motivations

Key Motivations Behind Researching New Solutions

Understanding the triggers that initiate the technology buying journey is essential for crafting targeted marketing campaigns. The study revealed that more than 60% of tech buyers begin researching new solutions due to inefficiencies in their current processes or a need to improve ROI . Decision makers are not passively exploring new technologies; rather, they are actively seeking solutions that address specific business challenges.

In the software industry, competitive pressures play a more significant role in driving technology adoption. Companies operating in this space are more likely to start researching new solutions due to the actions of their competitors. Given the rapid pace of innovation in software and the increasing influence of artificial intelligence, staying ahead of technological advancements is crucial for maintaining a competitive edge.

Company size and revenue also influence the motivations behind research. Organizations with fewer than 5,000 employees or under $500 million in revenue prioritize improvements in efficiency and functionality. These companies need to remain agile and adaptable, making it essential for their technology investments to address immediate operational needs. In contrast, larger enterprises tend to be more influenced by competitive dynamics and broader market trends, as their existing technology stacks are often already highly capable.

For marketers, this means emphasizing efficiency gains, cost savings, and business impact in their messaging. Demonstrating how a solution can directly address inefficiencies and enhance ROI will resonate with buyers who are actively seeking improvements to their current systems.

Consideration Stage

Buyer Stage: Consideration

The buyer journey continues with the Consideration stage. By now, tech buyers have moved past the initial spark of curiosity. They’ve surveyed the landscape, discovered promising solutions, and gathered insights from trusted sources. At this stage, buyers are digging deeper, narrowing their options, evaluating features, and determining which solutions truly align with their unique needs.

This is the phase where credibility becomes currency. Peer recommendations take center stage, not just influencing awareness but actively shaping opinions. Decision makers, especially at the executive level, are looking for real-world proof, stories of success, expert validation, and testimonials that speak to outcomes. It’s no longer just about what a product can do; it’s about what it has done for others.

For marketers, this stage offers a powerful opportunity to engage buyers through authenticity, relevance, and strategic content tailored to resonate with their specific challenges.

Capturing Buyer Interest

Effective Touchpoints to Capture Buyer Interest

Peer recommendations not only help buyers discover new solutions but also play a crucial role in capturing their interest. When asked about the type of content that most effectively captures their attention, tech buyers prioritized peer-driven insights , reinforcing the importance of testimonials, case studies, and word-of-mouth marketing.

Interestingly, C-level executives are particularly responsive to peer recommendations. This suggests that decision makers at the highest levels value the perspectives of other leaders within their industry, recognizing the credibility and relevance of their insights. Additionally, while social media is sometimes overlooked in B2B marketing, the survey results indicate that social media posts and ads are more likely to capture the attention of C-level executives than their less senior colleagues.

In addition, marketers should continue to leverage traditional content formats , including articles, blog posts, eBooks, and social media content, as over a third of buyers’ attention (36.6%) is still captured through these channels. Given these findings, marketers should focus on integrating peer testimonials into their content strategy. Case studies featuring real-world success stories, customer testimonials, and industry expert endorsements can significantly increase engagement and credibility.

Building Trust With Buyers

Driving Buyer Trust With Marketing Messaging

Tech buyers place their trust in peer and industry expert recommendations , seeking authentic validation from fellow industry professionals. This trend is particularly pronounced among C-suite executives, 83% of whom trust marketing claims that are backed by peer or expert recommendations.

Third-party review platforms also play a crucial role in building credibility, as they provide an unbiased source of information. Buyers trust reviews and testimonials because they offer firsthand insights into a product’s performance and reliability.

Knowing that buyers prioritize peer validation, marketers can use this to communicate how their solutions perform. The key is to reinforce marketing claims with credible, real-world proof, including testimonials, case studies, and independent reviews. Buyers are not just looking for promises; they want tangible evidence that a solution has delivered measurable results for organizations like theirs.

Content Engagement

Leveraging Content to Drive Engagement Throughout the Buying Journey

When researching new technology solutions, buyers are increasingly drawn to video content , particularly product demos and walkthroughs that visually demonstrate a solution’s capabilities. While in-depth product demos are essential at the bottom of the funnel, the survey findings suggest that video content is valuable at every stage of the buyer’s journey, from initial awareness to final decision-making.

Despite the rise of video, other content formats remain critical, making up 64.5% of buyer engagement. Preferred content formats vary depending on company size and revenue. Enterprises with more than 5,000 employees and over $500M in revenue find whitepapers and research reports more engaging, likely because they require data-backed insights to support large-scale purchasing decisions. On the other hand, smaller companies (less than 1,000 employees and less than $250M in revenue) prefer interactive tools and calculators, suggesting that they seek customized, hands-on evaluations of potential solutions.

To maximize reach, marketers should tailor content strategies based on audience segmentation. Video should be a core component but should not replace other content types. Instead, video should be integrated into broader educational resources, thought leadership materials, and interactive tools to engage buyers at every stage of the decision-making process.

Addressing Buyer Challenges

Addressing Buyers’ Specific Challenges With Evidence-Backed Marketing

Case studies remain critical tools for helping tech buyers assess a solution’s real-world impact. However, generic case studies are less effective than those tailored to potential buyers’ specific pain points and industries. Survey respondents emphasized that case studies should focus on challenges solved by companies similar to their own, helping them draw direct comparisons and benchmark potential outcomes.

This preference is particularly strong among smaller companies (less than 100 employees and less than $25M in revenue). Decision makers at these companies seek reassurance that a solution has successfully addressed challenges similar to their own before committing to a purchase.

For marketers, this underscores the need to build a diverse library of case studies that showcase success stories across different industries, company sizes, and use cases. By structuring case studies around specific challenges and measurable results, vendors can improve relatability and credibility, making it easier for buyers to see the direct value of a solution.

Decision Stage

Buyer Stage: Decision

In the final stage of the buyer journey, the stakes are higher. After weeks or even months of research, comparisons, and internal discussions, tech buyers arrive at the Decision stage. This is when options are evaluated, budgets are considered, and the pressure to choose the right solution becomes real.

At this stage, it is no longer just about features or familiarity; return on investment is the most important factor influencing final decisions. Buyers must justify their choice with clear evidence of value, whether through cost savings, improved performance, or long-term business impact.

However, ROI is only one part of the picture. Buyers are also considering how easily a solution can be implemented, how well it aligns with existing systems, and whether it can scale to support future growth.

For marketers, this is the moment to provide content that addresses specific concerns and decision criteria. Tailored messaging that highlights real-world success, operational benefits, and strategic advantages can help transform buyer confidence into commitment.

Decision Making Factors

The Most Important Factors in Technology Purchasing Decisions

When evaluating new technology solutions, ROI emerges as the most critical factor influencing purchasing decisions across the buying committee. Tech buyers must justify their investments by demonstrating clear financial and operational benefits. Given the often substantial costs associated with technology adoption, decision makers seek assurance that the chosen solution will deliver tangible value.

While ROI is the dominant concern, other factors such as ease of implementation, vendor reputation, and customization options (40.2%) remain important throughout the buying journey. Director-level buyers, in particular, are more focused on implementation challenges , as they are typically responsible for overseeing deployment. Vendor reputation carries added weight in finance and software industries due to regulatory considerations and security concerns.

Marketers must ensure that ROI messaging is central to their campaigns, supported by case studies and data-driven proof points. Pricing should be clear and support the case for investing in a new solution. Additionally, emphasizing ease of implementation and customization options can further strengthen the appeal of a solution, particularly for mid-level decision makers responsible for execution.

Establishing Relevance

Ensuring Marketing Messaging Is Relevant to Buyers

Tech buyers expect marketing materials to directly address their specific challenges and goals. A third of buyers prioritize messaging that highlights use cases tailored to their job roles. Decision makers want to clearly understand how a technology solution will help them solve their daily challenges and contribute to their strategic objectives.

Beyond immediate needs, 31.7% of buyers also consider scalability a crucial factor in determining whether a solution is relevant to their business. Organizations are looking for technologies that support long-term growth rather than requiring frequent replacements or costly upgrades. Scalability and flexibility must be emphasized in marketing messaging to show how a solution will continue to meet evolving business needs.

The level of seniority also influences how buyers perceive relevance. C-suite executives prioritize flexibility and customization options relatively more than Directors and VPs, likely due to their long-term, strategic focus. They want assurance that a technology solution can be adapted to fit future business requirements, rather than needing supplementary tools to fill functionality gaps.

Marketers need to create targeted content for all members of the buying committee (decision makers, influencers, and users). By addressing each role’s needs, vendors can highlight the value of their solutions, leading to stakeholder support. Effective marketing communication should solve current problems and promise long-term success.

Tech Buyer Personas

Different buyer personas influence the buyer journey at every stage, each bringing distinct priorities and decision-making styles. Tailoring your marketing and sales approaches to these personas is essential to effectively engage and resonate with them.

Persona Mapping Logic

Understanding the Persona Mapping Logic

Each of the questions in the 2025 Tech Buyer Preferences Survey was behaviorally tagged to reflect a particular buyer mindset, specifically, one of the five key tech buyer personas outlined here.

Respondents’ answers were scored based on these behavioral indicators. The persona with the highest score became their primary persona, offering a clear, data-backed picture of their decision-making style.

When designing go-to-market strategies, it’s not enough to know what kind of buyer you’re engaging, you also need to understand who they are within the organization. By aligning persona insights with seniority data, you gain a powerful tool to craft messaging and deliver content that truly reflects the intent and behaviors of tech buyers at every leadership level.

The Five Buyer Personas

The Five Tech Buyer Personas and What They Represent

From over a thousand aggregated responses, five clear persona archetypes emerged, each with distinct motivations, content preferences, and influence strategies. These personas are more than just profiles, they’re strategic lenses for crafting buyer-centric marketing and sales approaches.

Persona #1

Analytical Decision Maker

This persona is grounded in reason, research, and rigor. They prefer a logical flow to decision-making and gravitate toward content that validates claims with evidence. These buyers aren’t easily swayed by hype or opinion, they need to see the proof.

Behavioral Traits

- Demands clarity over creativity.

- Responds well to case studies, whitepapers, and peer-reviewed data.

- Needs a clear understanding of how a product works before buying.

Strategic Insight

When targeting Analytical Decision Makers, focus on creating structured content journeys. Offer these buyers resources that build a logical case from problem to solution, reinforced by third-party validation, metrics, and long-form technical content.

Persona #2

Cost-Conscious Buyer

Driven by financial prudence and return on investment, these buyers are laser-focused on the economic logic of a purchase. They’re not opposed to spending on new solutions, they just want to be sure the investment delivers measurable value.

Behavioral Traits

- Responds well to cost calculators, ROI dashboards, and pricing transparency.

- Often compares multiple vendors to weigh the value proposition.

- Wants upfront clarity on TCO (Total Cost of Ownership) and payback period.

Strategic Insight

To connect with Cost-Conscious Buyers, deliver straightforward, ROI-focused messaging. Use visuals and interactive tools to highlight cost savings, and avoid fluff; they’re looking for facts, not feelings.

Persona #3

Innovative Leader

Change agents by nature, Innovative Leaders seek to redefine the status quo. They keep a finger on the pulse of industry trends, emerging technologies, and disruptive business models. This persona sees technology not just as a tool, but as a competitive weapon.

Behavioral Traits

- Follows industry influencers and thought leaders.

- Prefers content that hints at what’s next, trends, predictions, or breakthroughs.

- Likely to champion early adoption within their organization.

Strategic Insight

Engage this persona with visionary content: think product roadmaps, beta programs, and future-state storytelling. Position your brand as a thought leader and partner in transformation, not just a vendor.

Persona #4

Relationship-Driven Influencer

This persona values trust above all. Their decision-making is shaped by reputation, recommendations, and emotional intelligence. These buyers often consult peers and advisors before making a commitment.

Behavioral Traits

- Places high value on brand reputation and customer experience.

- Seeks peer validation, testimonials, and trusted third-party reviews.

- Influenced by interpersonal outreach and advisory relationships.

Strategic Insight

Build rapport through authenticity and consistency. Let your most satisfied customers speak for you. Encourage executive sponsorships, user communities, and referral programs to create a trust-centric ecosystem around your offering.

Persona #5

Strategic Planner

Big-picture thinkers with a focus on long-term alignment, Strategic Planners don’t just evaluate features, they assess fit within the broader organizational and technical landscape. They want to know how a solution grows with them, adapts over time, and contributes to their mission.

Behavioral Traits

- Interested in customization, scalability, and future readiness.

- Looks for transparency around risks, integration requirements, and change management.

- Seeks educational content to evaluate not just “what” but “how.”

Strategic Insight

Speak to their strategic worldview. Offer implementation guides, customer success frameworks, and co-creation opportunities. The more you demonstrate adaptability and strategic alignment, the stronger your appeal.

Personas by Seniority

Mapping Personas to Understand Senior Leaders’ Buying Preferences

The intersection of persona type and seniority level reveals powerful behavioral patterns. Here’s how each persona is distributed across C-Level, VP, and Director respondents based on aggregated survey results:

Key Insights into Senior Decision Makers

C-Level Executives

C-level leaders are primarily concerned with business-wide impact and bottom-line ROI. They’re highly engaged with innovation but will only pursue it if there’s a clear financial or strategic benefit. Messaging for this group should focus on financial outcomes, competitive advantage, and market leadership.

Top Personas:

- Cost-Conscious Buyer (40%)

- Innovative Leader (34%)

Recommended Tactics:

- Executive summaries with ROI projections

- Visionary thought leadership

- High-level benchmarking reports

VP-Level

VPs are often cross-functional facilitators who champion change. They value relational trust (especially with internal stakeholders and peers) and lean into innovation to drive departmental performance. VP-level leaders are also key influencers in vendor selection.

Top Personas:

- Relationship-Driven Influencer (41%)

- Innovative Leader (38%)

Recommended Tactics:

- Case studies with peer quotes

- Interactive demos and virtual events

- Industry expert endorsements

Director Level

Directors are execution-focused and detail-oriented. They seek scalable solutions that align with operational goals and long-term initiatives. Their input is vital in evaluating implementation complexity and future readiness.

Top Personas:

- Strategic Planner (44%)

- Analytical Decision Maker (38%)

Recommended Tactics:

- Technical documentation and implementation guides

- Roadmaps and integration details

- Long-form educational content

Summary Table: Persona Distribution

| Seniority Level | Dominant Personas | Key Buying Concerns | Effective Content Types |

|---|---|---|---|

| C-Level |

Cost-Conscious Buyer |

|

|

|

Innovative Leader |

|

|

|

| VP-Level |

Relationship-Driven Influencer |

|

|

|

Innovative Leader |

|

|

|

| Director |

Strategic Planner |

|

|

|

Analytical Decision Maker |

|

|

Engaging The Buyer Personas

Turning Buyer Persona Insights into Strategic Engagement

Knowing your buyer’s persona is essential, but knowing their position in the organization is what makes that insight powerful.

The 2025 Tech Buyer Preferences Survey revealed not only how buyers think, but how those mindsets shift based on where they sit in the org chart. A Strategic Planner at the Director level approaches decisions very differently than a Cost-Conscious C-level executive, even if both are involved in the same buying decision.

By overlaying persona data with seniority insights, marketers can move from generic segmentation to precise engagement:

For marketers, this means crafting campaigns tailored not just to pain points, but to leadership priorities. For sales, it means knowing whether you’re talking to the budget holder, the internal champion, or the tactical evaluator, and adjusting your pitch accordingly. For product and strategy leaders, it’s a roadmap for aligning go-to-market efforts with real-world buyer psychology and organizational roles.

When you combine what motivates someone with the role they play, you unlock the ability to deliver the right message to the right person at exactly the right moment.

Key Takeaways

Key Takeaways for B2B Tech Marketers

The 2025 Tech Buyer Preferences Survey highlights several actionable strategies for engaging technology decision makers. By combining insights on buyer stages with detailed analysis of buyer personas, marketers can create more targeted and effective campaigns that speak directly to the unique needs and motivations of each decision maker throughout the buying journey.

Tech buyers trust their peers.

Decision makers, particularly at the executive level, rely heavily on peer recommendations and industry expert opinions when evaluating new technology solutions. They want to hear from professionals who have already implemented and tested a product in a real-world setting. Customer testimonials, case studies, and third-party review platforms serve as critical trust-building tools, offering buyers unbiased insights into solution performance. Marketing efforts should focus on amplifying these peer-driven, evidence-backed narratives throughout their messaging, ensuring that buyers have access to real, verifiable success stories that align with their specific needs and industry challenges.

ROI is the top priority.

Tech buyers need clear, quantifiable proof that a solution will generate a strong return on investment. New technology often requires significant financial and operational investment, making decision makers highly focused on cost savings, efficiency gains, and long-term value. To resonate with this audience, marketers must move beyond high-level promises and provide data-driven case studies, ROI calculators, and customer success metrics that validate the financial benefits of their solutions. Messaging should clearly articulate how a product reduces costs, improves productivity, and contributes to overall business growth.

Personalization is critical.

A one-size-fits-all marketing approach is not effective for engaging technology buyers. Decision makers across industries, company sizes, and job roles have unique challenges, priorities, and evaluation criteria that shape their purchasing decisions. Tailored messaging that speaks directly to each buyer persona’s specific concerns creates a stronger connection and increases the likelihood of engagement. Marketers should segment their audiences carefully and develop role-specific content that demonstrates how their solution meets the precise needs of each decision maker in the buying process.

Video content enhances engagement.

Video has emerged as a powerful tool for educating and influencing tech buyers at every stage of their decision making journey. Buyers prefer dynamic, visual demonstrations over static content, making video demos, case study interviews, and thought leadership discussions particularly effective. Short, engaging videos that highlight product capabilities, real-world use cases, and customer testimonials can capture attention early in the buyer’s journey and provide compelling proof of value. Additionally, integrating video into blog posts, whitepapers, and interactive tools can increase engagement and retention across multiple content formats.

Case studies should be highly relevant.

While case studies remain one of the most effective forms of content for influencing tech buyers, generic success stories do not drive action. Buyers want to see proof that a solution has delivered measurable results for organizations similar to their own. Marketers should invest in developing a diverse library of case studies that address a wide range of use cases, ensuring that prospects can find stories that resonate with their unique needs. The most compelling case studies clearly define the problem, outline the implementation process, and showcase tangible business outcomes, making it easier for buyers to envision success within their own organization.

By aligning marketing strategies with these findings, B2B technology marketers can engage decision makers more effectively, build lasting trust, and drive higher conversion rates. Understanding what tech buyers prioritize allows marketers to craft campaigns that resonate with their audience’s real concerns and ensures that marketing efforts not only capture attention but also provide the depth of information buyers need to make confident decisions. As technology purchasing becomes increasingly complex and competitive, marketers who embrace these data-driven insights will be best positioned to influence decision makers, differentiate their solutions, and drive sustained business growth.

Conduct Your Own Survey

Understand your buyers’ motivators and challenges with SURVEY from BlueWhale Research. SURVEY gathers research insights from your audience with questions tailored to the topics most important to your marketing efforts. SURVEY results can be used for content creation (such as this resource center), to generate demand with relevant insights into your audience, to enable your Sales team with real-time market intelligence, and more.